La energía solar: un paso hacia un futuro más sostenible en nuestras viviendas

En un mundo cada vez más preocupado por la sostenibilidad y el cuidado del medio...

Read more

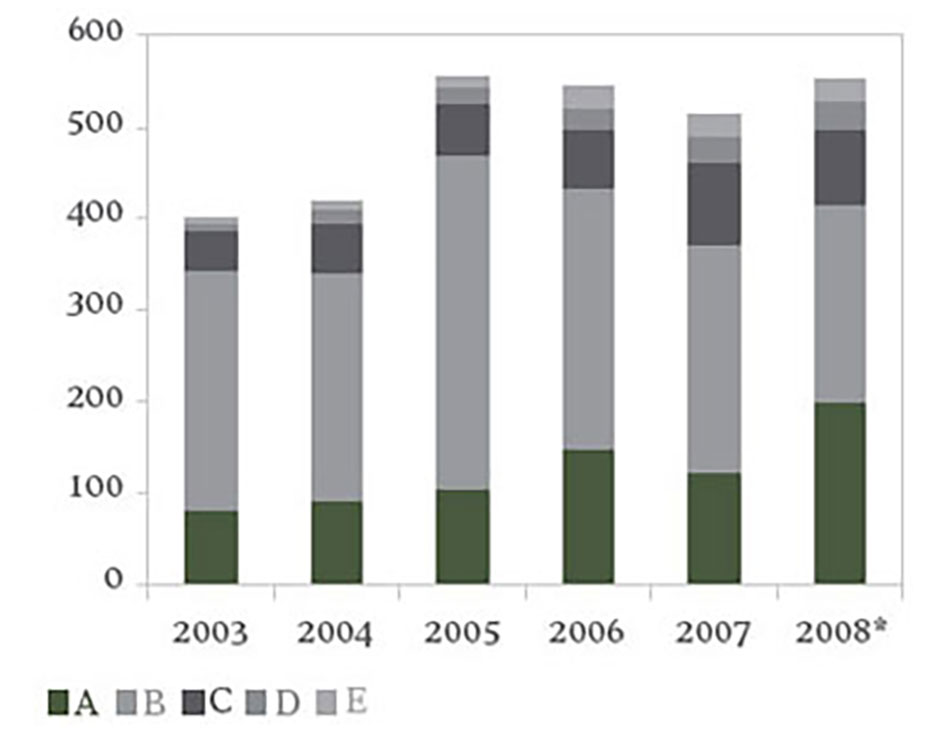

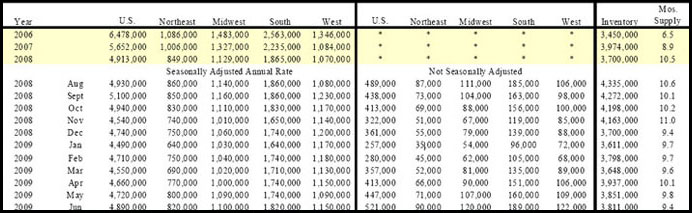

Parrafo bloque info mercado 01

Parrafo bloque info mercado 02

Parrafo bloque info mercado 03

Parrafo bloque info mercado 04

Parrafo bloque info mercado 05

En un mundo cada vez más preocupado por la sostenibilidad y el cuidado del medio...

Read more

El eclipse total del 8 de abril de 2024 en Mazatlán. ¡Norteamérica se prepara para...

Read more

En RE/MAX Sunset Eagle estamos emocionados de compartir contigo las maravillas que...

Read more